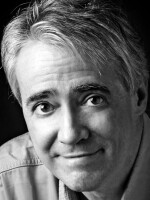

SCOTT SIMON, HOST:

Here's a tax tip with the filing deadline less than a month away. If your adjusted household income is less than $73,000, you don't have to pay to file to the IRS, but only a tiny percentage of those eligible for free filing actually take advantage of it. Why? Justin Elliott, a reporter with ProPublica, has been reporting on this issue for nine years now. Mr. Elliott, thanks for being with us.

JUSTIN ELLIOTT: Good to be here.

SIMON: And why do so few people take advantage of this option for free filing? Is there any one answer?

ELLIOTT: Well, I would say the biggest factor is confusion between the sort of truly free IRS-sponsored option and then a bunch of commercial options that are advertised as free but are not always free. So it becomes very confusing very quickly.

SIMON: Well, explain that to us. Are you referring to people that are using a tax prep service or software?

ELLIOTT: I am. So there's a lot of offers from companies like TurboTax and H&R BLOCK that are labeled as free that are sometimes free but sometimes sort of put users on an off ramp into paying a fee. The IRS has this program called Free File that if you manage to find it, which very few people do, you will actually get a free return if you make under the $73,000. So if you just Google IRS Free File, and make sure to click on the dot-gov site and try to ignore all the ads for other services labeled as free - as long as you start from the IRS site, you should get that free federal return.

SIMON: What's kept you on this story for nine years? I think Woodward and Bernstein were done in just three or four.

ELLIOTT: (Laughter) Right, a couple things. One is it affects so many people. I get tons of calls and emails every year. But also, I mean, I think it's an interesting story of privatization of government services and how that's played out over time. I mean, the history here is 20 years ago during the George W. Bush administration, the IRS was actually considering offering its own official tax prep service. And the private tax prep industry didn't want that to happen. And we ended up with this sort of strange hybrid system that we're living in today.

SIMON: Some of ProPublica's coverage mentions that in other countries, people actually don't file taxes at all. The government essentially does that for them. Why doesn't that happen in the U.S.?

ELLIOTT: So in a lot of other developed countries, you essentially get a tax return that's already been filled out by the tax agency, and you sort of just look it over and click submit. One of the reasons that doesn't happen here is the influence and lobbying of the for-profit tax prep industries. And there's been really decades of lobbying by that industry to ensure that the IRS doesn't take a sort of more robust role in helping people file their taxes.

SIMON: Yeah. What's the argument that the tax preparation companies make? I mean, is it essentially - why should you trust the government to figure out your taxes?

ELLIOTT: That's one of the core arguments. You know, the IRS obviously has an interest in collecting as much money as possible. So why would you trust them to sort of prepare your taxes? But the companies also point out people are sort of voting with their feet and they appear to like using these products. So we've heard from a lot of Americans who have just never heard of the IRS Free File option and have been paying TurboTax or H&R BLOCK for years and years when they could have been getting basically the same product for free if they had simply known about the IRS option. So there's definitely a population of people like that as well.

SIMON: Justin Elliott, a reporter of ProPublica, thanks so much.

ELLIOTT: Thank you.

[POST-BROADCAST CLARIFICATION: In this story, and in a previous headline, we suggest that free filing is limited to those making less than $73,000. This story focuses on the IRS Free File program for those in that tax bracket.]

(SOUNDBITE OF KHALID SONG, "SATURDAY NIGHTS") Transcript provided by NPR, Copyright NPR.